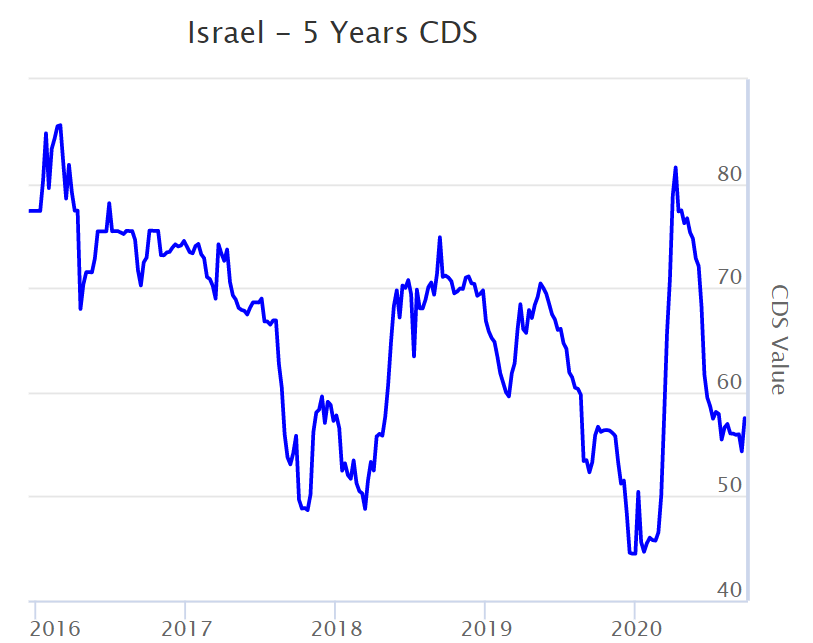

CDS in Python; Extracting Israel Probability of Default implied by Israel 5 Years CDS Spreads | by Roi Polanitzer | Medium

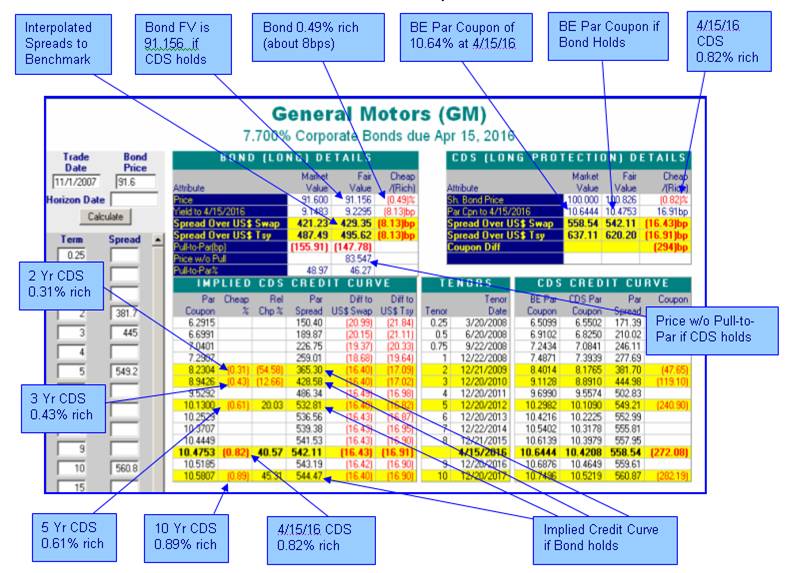

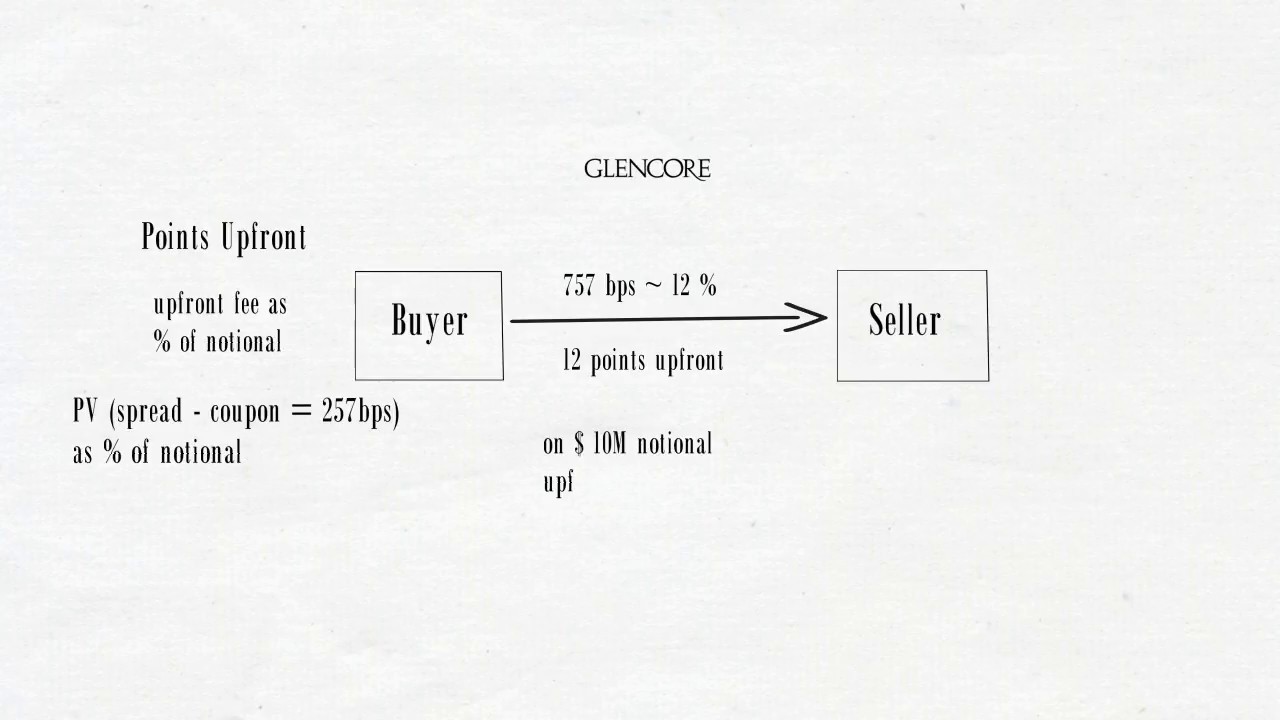

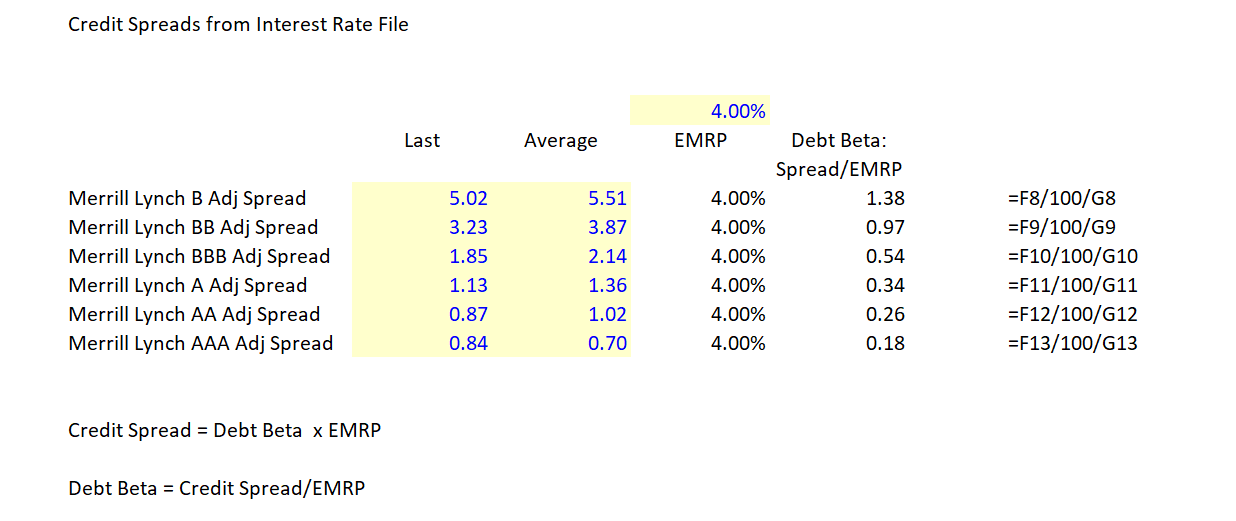

1 Credit Swaps Credit Default Swaps. 2 Generic Credit Default Swap: Definition In a standard credit default swap (CDS), a counterparty buys protection. - ppt download

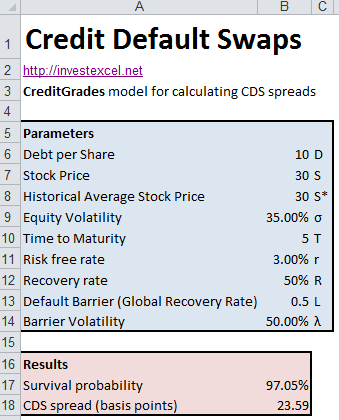

credit risk - Deriving default probability from CDS spread via stripping - Quantitative Finance Stack Exchange

:max_bytes(150000):strip_icc()/Term-Definitions_Credit-default-swap-63dfdd6f916e4dfa8fb524fc387273c6.jpg)